In the 2016 Federal Budget the Treasurer stated that the Government would introduce amendments to the Wine Equalisation Tax (WET) legislation that would have effect from 1 July 2019. These amendments would, amongst other things, ‘tighten’ (ie, restrict) the rules regarding the eligibility of wine producers to access the WET rebate. Between then and early this calendar year, Treasury called for responses and undertook consultation as to the extent and form of these amendments. Various industry bodies, wine producers and others (including ourselves at DW Fox Tucker Lawyers) provided comments.

Following that consultation, in April of this year Treasury published exposure legislation giving effect to Treasury’s proposed reforms and on the final sitting day before winter Parliamentary recess (ie 22 June 2017) final legislation was introduced and read for a second time in the House of Representatives. The key changes with application date to assessable dealings from 1 July 2018 were as follows:

- The WET producer rebate cap for each producer (or group of associated producers) will be reduced from $500,000 to $350,000 per annum;

- The test for whether two producers are “associated producers” will be tightened by extending the timing of the test from the end of the financial year to at any time during the financial year;

- the WET producer rebate will be limited to wine for which:

- producers maintain ownership of the wine’s source product throughout the wine-making process;

- 85% of the final product originated from source product that was owned by the producer;

- producers have packaged the product in a container that does not exceed five litres (or 51 litres for cider and perry); and

- producers have branded the final product with a registered trade mark owned by that producer (or a common law trade mark if the mark does not qualify for registration); and

- grape wine product containing between 700 millilitres and less than 850 millilitres of grape wine per litre will now be subject to excise and excise equivalent customs duty rather than the WET.

We do not provide detailed commentary on these changes.

Instead, in response to a number of similar questions being asked by our clients, we thought to highlight the rules regarding the application and transition of the existing rules to the new rules.

For example:

- What of unsold wine stock already on hand that has been produced prior to the publication of these provisions, or wine produced between now and the end of 30 June 2018?

- If rebatable under the existing rules, will that wine continue to be rebatable?

- Further, will that (what we shall refer to as “Old Rebatable Wine”) continue to be rebatable after 1 July 2018, even if under the new rules it would not be?

For example, in a practical context can vintage 2016 or 2017 wine be sold after 1 July 2018 and still get the benefit of the WET rebate if:

- It is sold as bulk wine, or does it require trade mark labelling and to be sold up to a maximum of 5 litre containers? Or

- Subject to the earlier producer rebate provisions (that are also to be repealed), if less than 85% of the wine was produced from source product owned by the producer before the wine making process?

In order to answer these questions it is necessary to consider the transitional provisions, noting that when any taxation law is amended, particularly one which is a tightening or a narrowing of existing rules that have application on a future date, separate provisions are introduced to deal with the change so as to potentially soften the immediacy of any detrimental impact.

Whilst the position under the exposure draft legislation and its accompanying explanatory memorandum was, in our opinion, confused, the final Bill as tabled before Parliament provides further clarification.

The application and transitional provisions note that the amendments to WET rebate eligibility apply to assessable dealings in wine from the FY2019 financial year (ie from 1 July 2018). They go on to provide that the amendments also apply to assessable dealings in circumstances where the crushing of the source product for more than 50% of the wine occurred on or after 1 July 2018 (thereby presumably picking up wine produced from the 2018 vintage).

Under the exposure draft this raised for us the question as to whether either:

- the new WET rebate eligibility rules:

- apply to all assessable dealings from 1 July 2018, irrespective of the year of vintage of that wine; and

- also apply to assessable dealings in relation to 2018 vintage wine, even if those assessable dealings are before 1 July 2018.

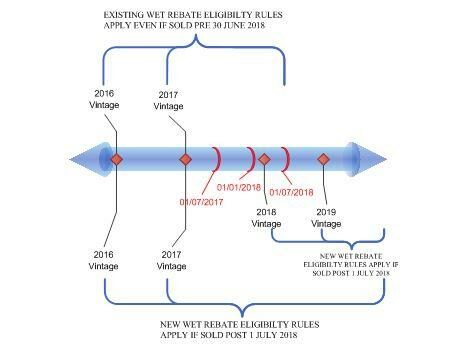

Diagrammatically:

(Interpretation A)

OR

- the:

- new WET rebate eligibility rules apply to assessable dealings from 1 July 2018 bringing into those rules wine produced from the 2018 vintage; and

- current existing WET rebate eligibility rules will continue to apply to assessable dealings for all existing wine stock on hand and wine produced this 2017 vintage (unless that wine is blended with more than 50% 2018 vintage wine) even if that dealing is after 1 July 2018.

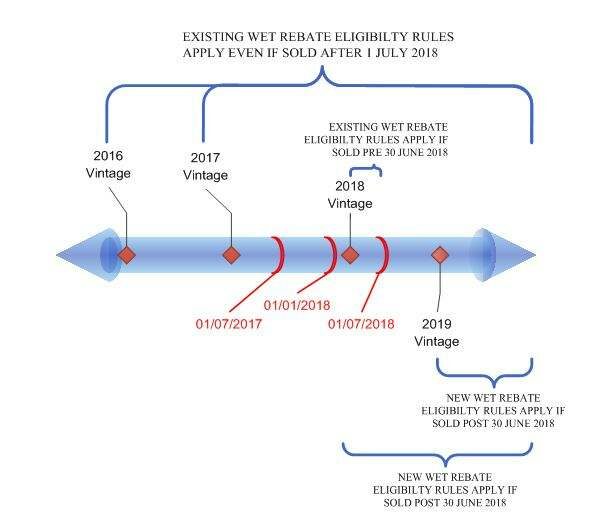

Diagrammatically:

(Interpretation B)

It was not clear as to which of these two interpretations Treasury intended in drafting the exposure draft provisions. On a literal reading of the draft application provisions, we believed that, on balance, Interpretation A is the most accurate.

However it would have been inequitable in our opinion for there to be no grandfathering of existing product in tank and of wine from the current 2017 vintage to enable its eligibility. Otherwise, there would arguably be an unfair level of retrospective taxation.

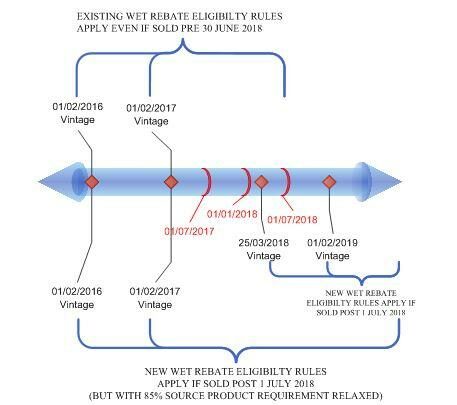

The final bill as tabled before Parliament to some extent expands the transitional application of the provisions and provides further specifics, noting that it appears a hybrid of the above interpretations. That is, broadly speaking – with respect to 2017 year and earlier year vintage wine (excluding fortified wine), the 85% ownership of source product requirement does not apply to wine:

- if the crushing of the source product for more than 50% of the wine occurred before 1 January 2018; and

- the producer of the wine owned it immediately before 1 January 2018; and

- it meets the following requirements:

- an assessable dealing with the wine (in most cases a sale) occurs on or before 30 June 2023; and

- was bottled on or before 30 June 2018, or correctly labelled with a vintage date of the wine as being for the 2017 year or an earlier year.

However, notably the earlier producer rebate rule continues to apply to wine to which this transitional rule applies.

So… what does this mean…? Does it mean that the new WET eligibility rules don’t apply at all to 2017 year and earlier year vintage wine existing product in tank if more than 50% of the wine was crushed before 1 January 2018? No, for there is no complete grandfathering of that wine stock. That is, for 2017 year and earlier year vintage wine the bottling and trade mark requirement remains.

Diagrammatically, therefore the new WET rules apply in broad terms as follows:

Consequently, wine producers that have existing wine stock on hand that is unlikely to meet the bottling and trade marking requirements under the new rules, knowing that it will not otherwise be grandfathered post 1 July 2018 might best consider whether they are able realise their stock before then.