On Tuesday 15 September 2020, the Federal Government registered new rules[1] to regulate the JobKeeper wage subsidy scheme.

The new rules give effect to JobKeeper 2.0, which extends the wage subsidy scheme for a further six months and introduces new eligibility tests for employers and employees.

Extension periods

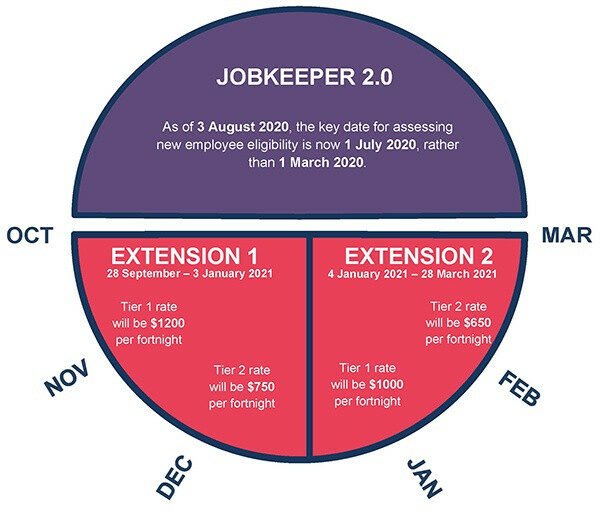

JobKeeper 2.0 involves two separate quarterly extension periods:

- 28 September 2020 to 3 January 2021 (Extension 1); and

- 4 January 2021 to 28 March 2021 (Extension 2).

The new rules treat each of the two quarterly extensions as separate and distinct periods with an employer required to demonstrate eligibility for each of these two quarterly extension periods.

In practice, if economic conditions improve in response to the easing of Government restrictions - particularly outside of Victoria - it is likely that many employers will only meet the eligibility criteria for Extension 1 of the wage subsidy scheme.

Assessment of decline in turnover

An actual decline of GST quarterly turnover (rather than a projected GST figure under the current rules) of 30% will be used to determine eligibility for most employers[2] in South Australia under JobKeeper 2.0.

The relevant comparison periods for the decline of GST quarterly turnover are:

- Extension 1 – a decline in the September 2020 quarter by comparison to the equivalent quarter in 2019; and

- Extension 2 – a decline in the December 2020 quarter by comparison to the equivalent quarter in 2019.

Employee eligibility assessment

The new reference date for assessing employee eligibility is now 1 July 2020.

To determine if your employees are eligible consideration must be given to the following:

- employees will remain eligible if they have been eligible employees on or before 2 August 2020 using the 1 March 2020 test; or

- they satisfy the new 1 July 2020 test.

The 1 July 2020 test requires that the employee was employed as either a full-time, part-time, fixed-term employee or a long-term casual employee and not a permanent employee of any other employer.

Other criteria apply for these new eligible employees which include that they must have been 18 years of age or older as at 1 July 2020 and that they meet the criteria of an Australian resident.

JobKeeper Wage Subsidy Amount

The JobKeeper Wage Subsidy Amount will contain two-tiered payment rates for eligible employees. To determine the appropriate payment rate, employers will need to assess the total number of hours each eligible employee worked during the two quarterly extension periods.

An eligible employee will have access to the higher-tiered rate if, subject to special rules about averaging, they work 80 hours or more during the 28-day period immediately prior to 1 March 2020 or 1 July 2020.[3] The employee’s total hours of work includes paid leave and paid absence on public holidays. If the eligible employee doesn’t meet the higher-tiered rate criteria, the lower-tiered rate will apply.

If employers remain eligible for the wage subsidy scheme during the second quarterly extension period, the two-tiered payment rates will reduce as the Government seeks to reduce the continuing cost under JobKeeper 2.0.

If you have any questions about the changes to the wage subsidy scheme and how they may relate to your business, please contact one of our Employment Law experts.

Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 8) 2020

An employer with an aggregated turnover of $1 billion or less.

The period with the higher number of hours is to be used for employees who were eligible at 1 March 2020